- The Business of YouTube

- Posts

- Pricing the Game: How Prediction Markets are Turning Sentiment into a Financial Asset

Pricing the Game: How Prediction Markets are Turning Sentiment into a Financial Asset

Why DAZN and MLS are Embedding Markets into the Live Stream

The Business of YouTube

A weekly strategic lens for senior leaders into how YouTube is reshaping the business of technology, sports, music, entertainment, and culture.

Welcome!

To your favourite newsletter, The Business of YouTube, brought to you by Paola Marinone and Bengü Atamer, founders of BuzzMyVideos and previously at YouTube and Google. We are bringing our exclusive insights from 20 years of experience leading strategy at YouTube and Google.

The YouTube Trading Floor: Why Your Live Chat is the New Market Oracle

The Liquidity of Fandom: Why Sports CEOs are Betting on Prediction Markets

“Audiences Don’t Just Want to Watch, They Want to Shape It”: An Interview with Ed Abis from Dizplai👇

For decades, the sports industry has measured success through passive reach, eyeballs, impressions, and ratings.

But in 2026, the currency has changed. We have entered the era of priced sentiment.

With the recent wave of partnerships, most notably DAZN x Polymarket and MLS x Polymarket (Jan 2026), sports rights are becoming to be about the underlying market.

We believe, a prediction market is beyond "Betting 2.0." It is more like a real-time, dollar-backed Demand Index for your product.

THE BIG MOVES: 2026 Partnership Landscape

The early weeks of 2026 have seen a "land grab" for prediction market exclusivity. Here is how the leaders are positioning themselves:

Partner | Rights Owner | Integration | YouTube |

Polymarket | DAZN | In-app trading directly within the global live stream. | Real-time "Probability Overlays" on live fight-night clips. |

Polymarket | MLS | Exclusive partner for MLS Cup & Leagues Cup. | Using YouTube Community polls as leading indicators for market moves. |

Polymarket | TKO (UFC/Boxing) | First-ever "Fan Prediction Scoreboard" in-broadcast. | Creator-led "Market Watch" livestreams on YouTube. |

Kalshi / Poly | NHL | Digitally Enhanced Dasherboards (DED) showing live odds. | "Market Crash" Shorts: Clipping the moment the odds flipped. |

To understand how interactive data fuels these new markets, we spoke with Ed Abis, CEO at Dizplai. His team sits at the intersection of live broadcast and second-screen engagement, powering the "active content" layers for global rights holders.

Q1: How can rights owners use 'pre-broadcast' engagement data to protect market integrity against 'courtsiders' or high-frequency traders?

Ed Abis: “I think the industry needs to get ahead of this quickly... Fan behaviour often moves faster than the broadcast. Chat velocity spikes, sentiment shifts, poll responses, all of this captures the emotional pulse before the traditional TV feed catches up. First, it’s an early warning system; if chat activity spikes but the broadcast hasn’t reflected that moment yet, that delta becomes a signal to flag suspicious market activity. Second, fan engagement creates a 'crowd truth' layer.“

On Integrity: The "Crowd Truth" vs. The Courtsider

Q2: DAZN's integration of Polymarket suggests that real-time fan sentiment is now a tradeable asset. Based on the interaction data you collect, polls, chat velocity, and sentiment spikes on YouTube, how closely do these 'engagement signals' correlate with shifts in prediction market liquidity? Are we reaching a point where second-screen activity serves as the 'primary oracle' for setting event contract prices?

Ed Abis: “I think we're closer to this than most people realise.

For instance, The DAZN and Polymarket partnership is significant because it makes the connection between viewing and trading explicit. You're watching a fight, you're seeing real-time probability data on screen, and the line between being a fan and being a market participant starts to blur.

What TKO and UFC have done with Polymarket is arguably even more interesting. They've created a Fan Prediction Scoreboard that visualises how the crowd is forecasting each fight as it unfolds. That's essentially turning fan sentiment into a data-driven narrative in real time, and it's the first time a major sports organisation has given a prediction market platform exclusive rights to embed this directly into the broadcast experience.

The reason is simple. Fans on YouTube and social platforms are reacting in real time, often faster than the traditional broadcast. They're closer to the raw emotion of the moment. And when you have hundreds of thousands of people simultaneously expressing a view through a poll, a prediction, or just the velocity of their chat messages, that's an enormous amount of signal.

I think the "primary oracle" framing is really interesting. In prediction markets, an oracle is the source of truth that settles a contract. Traditionally that's official results or verified data feeds. But what I see emerging is fan engagement data becoming a "sentiment oracle." Not settling the contract, but absolutely leading the price discovery.”

On Market Oracles: Sentiment Leading Price

"I'd bet that if you overlaid fan engagement data with Polymarket's order flow, you'd see fan behaviour leading the market movement, not following it, in fact, we have and it does! Performance data tells you what happened. Fan engagement data tells you how it feels.

In prediction markets, price is fundamentally about collective feeling."

Q3: Which interactive features show the highest conversion from 'passive viewer' to 'active market participant'? Is the future a rev-share on the trade rather than a CPM on ads?

Ed Abis: “The shift from viewing to trading is the natural evolution of the shift from passive to active audiences; audiences don't just want to watch content, they want to shape it. Prediction-based formats are the highest converters because when you give someone the chance to predict what happens next, the conversion is dramatic. The reason is the 'IKEA Effect', when people contribute, they value it more, deepening engagement and watch time as they check back to see if they were right.

The bridge between free prediction features and actual trading is a funnel where free polls build the habit before offering trades with real stakes. While CPM isn't going away, the rev-share on trade model is where the growth is because you are monetizing conviction rather than just attention. Conviction is more valuable to stakeholders as fans who have made a trade are 'locked in' and won't leave at halftime.

This peer-to-peer exchange model feels more aligned with fan-first principles than traditional betting, and with $24 billion in trading volume already at Kalshi, the scale is there. The real point is the engagement layer, the interactive features and community energy, that converts a viewer into a trader inside the content experience. The organizations that build for this participation will define the next era of sports media.”

On Monetization: Moving from CPM to Rev-Share

"In a CPM model, you're monetizing attention. In a prediction market rev-share model, you're monetizing conviction. Conviction is worth significantly more because it comes with higher engagement, longer watch times, and repeat behavior. The fan who's made a prediction trade on the outcome of a fight isn't leaving at half time."

THE YOUTUBE EDGE: Capturing the "Second Screen"

In our view, YouTube is of course where the "Oracle" lives.

While the game happens on the first screen, the valuation of the game happens on the second.

The "Oracle" Effect: High-velocity YouTube chats and real-time polls are now "front-running" the markets. Senior leaders are using this data to protect market integrity, identifying "sentiment spikes" seconds before they reflect in the trading volume.

Contextual Commerce: If a fan votes in a YouTube poll that a player will score next, the DAZN/Polymarket integration allows for a one-click conversion from "opinion" to "trade." This is the shortest path from engagement to revenue in sports history.

Retention in the Blowout: Prediction markets solve the "fourth quarter problem." Even in a 30-point blowout, the spread and micro-contracts (e.g., "Will the backup QB throw a TD?") keep the YouTube "Watch Time" metrics high.

THE BOTTOM LINE

If you own the rights, you own the data that moves the market. On YouTube, that data is generated every time a fan hits a button.

"The win is more than a score in these times; it's in the spread. If you aren't pricing your fans' expectations in real-time, you're leaving the most valuable data on the table."

Want to discuss how to shape your YouTube strategy, talk to us.

Further Reading on Prediction Markets

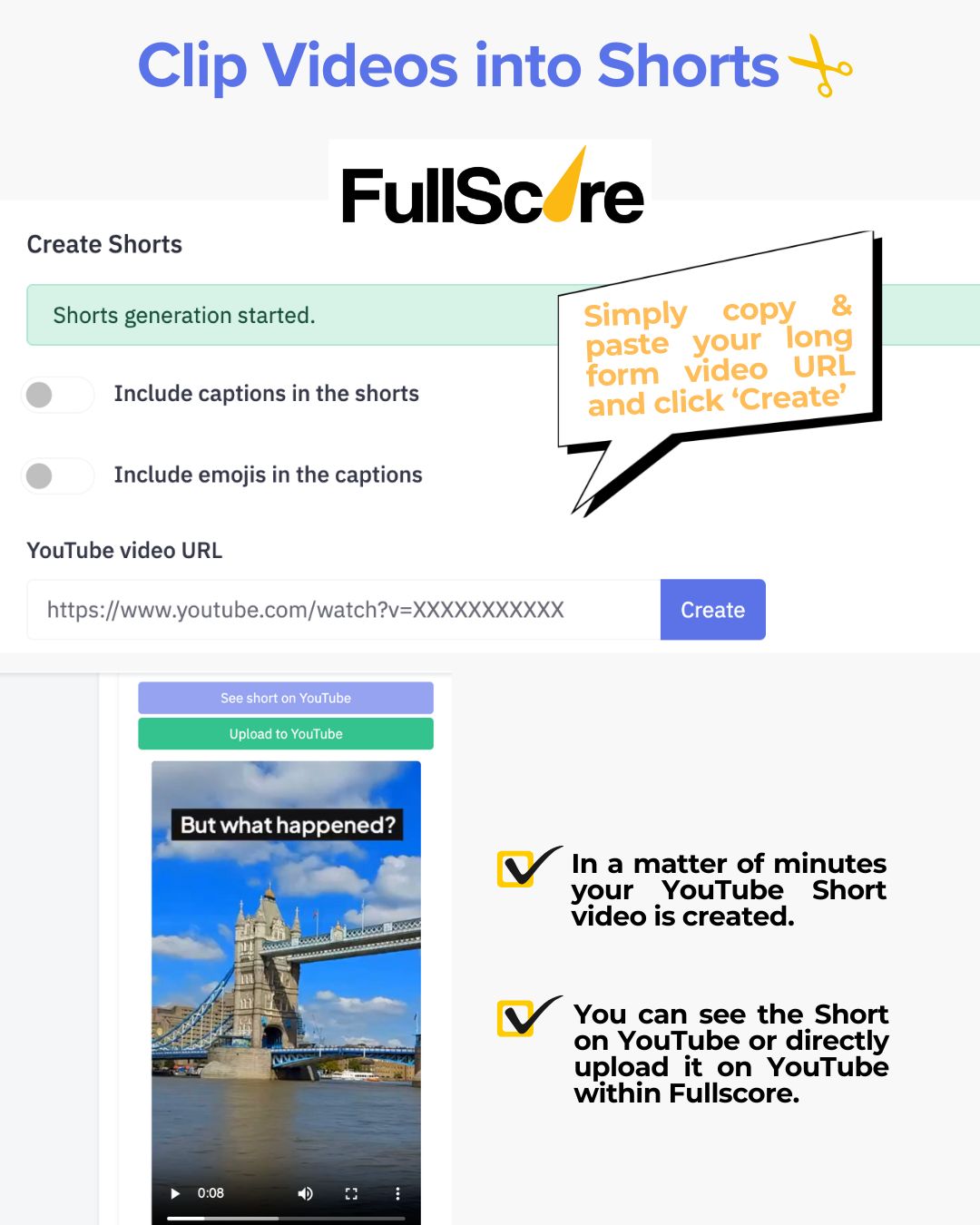

New FullScore.AI Feature: Turn Your Long-Form Videos into Viral Shorts Instantly.

Stop leaving views on the table! 🚀 FullScore just got a major upgrade: AI Short-form Clipping is live. Simply paste your video URL, and let our AI handle the rest—from selecting the best moments to adding viral-style captions. Turn your existing content into a growth engine today.

FullScore.AI Thumbnail Optimiser

Click below to get a free YouTube channel audit and see how FullScore can help supercharge your YouTube channel with the click of a button.

Watch the latest The Business of YouTube Podcast

What are the best opportunities for sponsors in sport for teams and clubs?

Who is doing a great job already? Learn from the expert in the room: Alex Kopilow, Founder of Sponcon Sports

Subscribe to “Sponcon Sports" Newsletter

YouTube Paid Growth Opportunity: FREE 1000 Views! 🗣️

Boost Your Long-Form YouTube Video (On the House)

We’re feeling generous!

Growing a content on YouTube is hard work; especially long form content such as branded podcasts.

We want to make the "growth" part a little easier this week.

We’re launching a new promotional campaign, and we want to give you a complimentary 1,000 Guaranteed Views Campaign for your video on YouTube.

No invoices, no hidden fees, and no long onboarding calls.

To get started, we only need two things:

The YouTube link for the video you want to boost.

Your target country.

Want to claim your 1,000 views? Just reach out to [email protected] or [email protected] with your YouTube video link and target country, and we’ll handle the rest.

Weekly YouTube Round-Up 📰

INDUSTRY NEWS

That’s all for this week!

Not yet a subscriber? Join business leaders from YouTube to Disney to the Premier League, that read The Business of YouTube every week to get YouTube strategy breakdowns!

P.S Every week, we read all feedback we receive, which massively helps make The Business of YouTube as useful as possible for subscribers.

Vote on your thoughts from today's issue below. 👇

Was it useful? Help us to improve!

With your feedback, we can improve the newsletter. Click on a link to vote:

Vote below - What did you think of today's issue?Every vote helps us make the newsletter better for you the reader! |

See you next week 👋

Paola and Bengü

Paola Marinone, Founder & CEO BuzzMyVideos |  Bengü Atamer, Co-Founder & Director BuzzMyVideos |

The Business of YouTube is powered by BuzzMyVideos and FullScore.

About BuzzMyVideos: Founded by Ex Google/YouTube Executives, BuzzMyVideos is the leading AI YouTube Growth Platform that drives hyper-growth & new revenue from and on YouTube. With clients like AC Milan, World Aquatics, United World Wrestling, and many others, BuzzMyVideos leads the way on Scaling Growth & Revenue on YouTube.